For most of this country's history, the price of an acre of land depended on agricultural potential - that is, what crops and livestock could be produced on the property.

But the days of cotton-and-cow-driven land values appear to be over for most Texas land. Nowadays, recreational potential is what it's all about.

Buyers want Mother Nature at her best: rolling hills, lakes, creeks, beautiful sunsets over rock outcroppings. They want to hunt and fish. They want to watch birds and wildlife. They want private weekend retreats.

So exactly when did agricultural land uses lose their dominance? A bit of history sheds light on the subject.

The United States began as an agrarian culture - a nation of farmers. Industrialization altered the course of society, moving it gradually toward the suburban nation of today.

After World War II, land markets that historically had been dominated by agricultural buyers began to draw urban-based investors interested in nonagricultural land uses. Inflation, population growth and generous income tax provisions for landowners increased demand for agricultural land. Land prices that had followed trends in agricultural income began to be influenced by these new sources of demand. Prices went up and continued to do so until the recession of the mid-1980s.

Demand for agricultural land had begun to subside early in the 1980s as the Federal Reserve took steps to rein in inflation. U.S. agricultural products were increasingly being priced out of the market, resulting in severe recession throughout the agricultural sector.

Prices for agricultural land began to slip earlier than 1986, but other sources of demand helped stabilize overall prices. However, the expanding recession and changes in income tax provisions made land less attractive to nonagricultural buyers. Farmers and ranchers came to dominate the market once more.

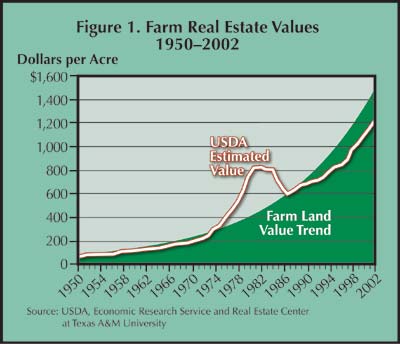

Figure 1 illustrates the history of U.S. agricultural real estate values as estimated by the U.S. Department of Agriculture (USDA) and the underlying trend in value over time. USDA values are based on estimates for agricultural land. The trend line represents underlying patterns in these USDA-estimated rural land values over time. The figure shows that the rate of increase of systematically rising values accelerated beginning in the early 1970s.

From $65 per acre in 1950, farm real estate values rose to $1,210 per acre in 2002. From 1950 through 1973, values increased gradually. A steep rise ensued following Russian wheat purchases and the energy crisis in the early 1970s. Land values remained above the expected long-term trend until the real estate market collapse in 1986. This value decline in the late 1980s brought values back in line with the estimated trend. Since then, land values have lagged below the long-term trend line.

The Center's ongoing survey of buyer motives indicates that farmers and ranchers were the dominant buyers throughout Texas at the time of the 1986 real estate market collapse. This remained the case until the early 1990s, when recreational buyers and investors reappeared as major market players.

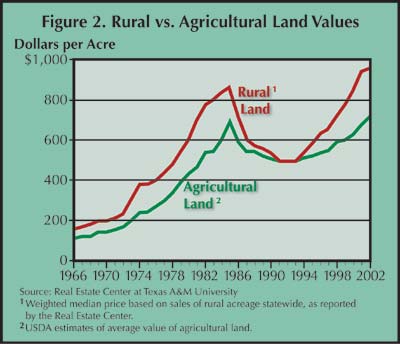

During the interval when farmers and ranchers were primary buyers, agricultural land values and rural land prices converged (Figure 2). The USDA and Center estimates differed by only $4 in 1992. However, as soon as recreational buyers returned to the market, the two estimates began to diverge. By 2002, the Center's reported price for rural land was 33 percent higher than the USDA estimated value of agricultural land. This disparity reflects the influence of nonagricultural buyers in the marketplace.

While rural land buyers formerly prized level, fertile farmland and improved pasture, current buyers prefer unimproved native rangeland. Brush and other types of wildlife habitat enhance land values more than agricultural productivity. High fences, established wildlife management plans, lakes, creeks and ponds - these are the factors influencing current market prices.

The effect high fences, which contribute to wildlife management plans, have on land values varies depending on both fence construction costs and property location.

In the Rio Grande Plain, it costs $10,000 to $12,000 per mile to install a quality game fence - more if the property has many corners, which require additional bracing. This equates to $35 or more per acre for a 2,000-acre ranch. In this area, an existing fence increases land values by about $75 per acre.

By comparison, construction costs in the Hill Country normally amount to $13,000 to $15,000 per mile for a similar fence. Topography and rocky soil substantially increase installation costs. In this market, an existing fence generally adds slightly more than $75 per acre to large tract values. Because small tract owners are unable to establish effective game management programs, a fence adds less than $75 per acre to the price of small Hill Country properties.

A wildlife management plan in place long enough to produce positive results adds $75 per acre to land values in the Rio Grande Plain. An established plan adds about the same in the Hill Country. Many Hill Country properties have exotic animals such as black buck antelope, axis deer and sika deer. Exotic game belongs to landowners, while native species belong to the state. Because exotic game is normally sold separately from the land, buyers can expect to pay more to acquire animals along with the land.

Good quail hunting territory is becoming more valuable. Most ranches with effective plans in place have begun to install quail watering systems. The value these systems add to the land usually equals the installation cost.

In the Rio Grande Plain, ponds of less than three surface acres add little more than their cost, less depreciation, to land values. Larger ponds enhance land value considerably. Analysis of sales in the northern Rio Grande Plain indicates that five-to-ten-acre lakes that hold water well add $4,000 to $5,000 to the overall value for each surface acre the lake covers. Properties above the Carrizo-Wilcox or Evangeline aquifers that have water sources, such as irrigation wells, to maintain water levels during dry periods generally recoup well costs, in added land value, if the properties are developed and managed well. This is not the case for tracts on the environmentally sensitive Edwards Aquifer.

Sales analysis of several properties with 100-acre ponds with irrigation wells indicates that the ponds add about $4,500 in value for each of the ponds' surface acres. The ponds must hold water and the wells must provide water during dry periods. Few Rio Grande Plain properties have permanent creeks, so wells are particularly valued.

In both the Rio Grande Plain and the Hill Country, the presence of ducks does not increase land value, but big bass do.

Few landowners can afford the luxury of leaving wildlife potential untapped. Active game management plans may now allow rural properties to qualify for open-space tax treatment under the Texas Property Tax Code. This wildlife use provision means recreational investors may no longer be required to maintain farm or ranch operations to qualify for reduced valuation.

Some ranches, however, are managed at low levels of intensity and must maintain an agricultural operation to obtain open-space treatment. On a season-long basis, a hunting lease on these properties brings more than $12 per acre to the landlord after deducting expenses. The same places have grazing rentals of $4 to $5 per acre. Obviously, hunting is the dominant activity.

An 8,000-acre, run-down, unfenced, overhunted property with poor water in La Salle County recently sold for $550 per acre. Three other properties within a five-mile radius were roughly 3,000 acres and brought $725 to $800 per acre. All were game fenced and had wildlife management activities under way. The size differential between the run-down ranch and the others accounted for only about $25 per acre in sales price.

The game fencing and wildlife management program were the key factors. Another property that was 10 percent improved pasture in irregular strips, not game fenced but well managed and well maintained, brought $650 during the same period. Obviously, game management substantially enhances land value.

So far, the Endangered Species Act (ESA) has not been a factor in the South Texas market. The difficulties landowners experienced in the Hill Country a few years ago never migrated far south. Because owners have had few problems, few have pursued Candidate Conservation Agreements (CCAs) to limit exposure to ESA penalties. There has been, however, some discussion of CCAs in the Lower Rio Grande Valley, where ocelot habitat occurs.

Farmland capitalization rates actually appear to be up slightly on the dry cropland in the coastal bend and Lower Rio Grande Valley. Recent studies indicated rates of just over 4 percent on properties with a good cotton base. Ranch rates in the Rio Grande Plain have increased slightly, primarily because hunting lease rate increases have outpaced the increase in land prices. Current rates for ranches, based on a landlord-tenant analysis, demonstrate overall capitalization rates ranging from 1.2 percent to 1.8 percent with an average of 1.6 percent.

Rural land markets, once dominated by farmers and ranchers, are now driven by non-agricultural buyers. These buyers are best characterized as recreational investors primarily influenced by a property's recreational potential rather than agricultural productivity.

For more information on USDA land values, go to: here.

Dr. Gilliland (c-gilliland@tamu.edu) is a research economist with the Real Estate Center at Texas A&M University and Vine is president of Vine and Associates in San Antonio, Texas.